If you are a business with a wages bill of 600000 equivalent to about five full-time employees on the average wage if. It only occurs when there is a supply shortage combined with enough demand to allow the producer to raise prices.

Yes Rising Inflation Is Bad For Stocks Seeking Alpha

You can expect to pay more for used cars and car rentals furniture airline fares hotels and everyday essentials like groceries and gas.

. Investors are bracing for an aggressive response by the Fed to fight inflation but theres still a lot of uncertainty about what the central. Consumers must put more effort more into shopping to find the best price. It is more difficult to stay aware of how one product compares in cost to another.

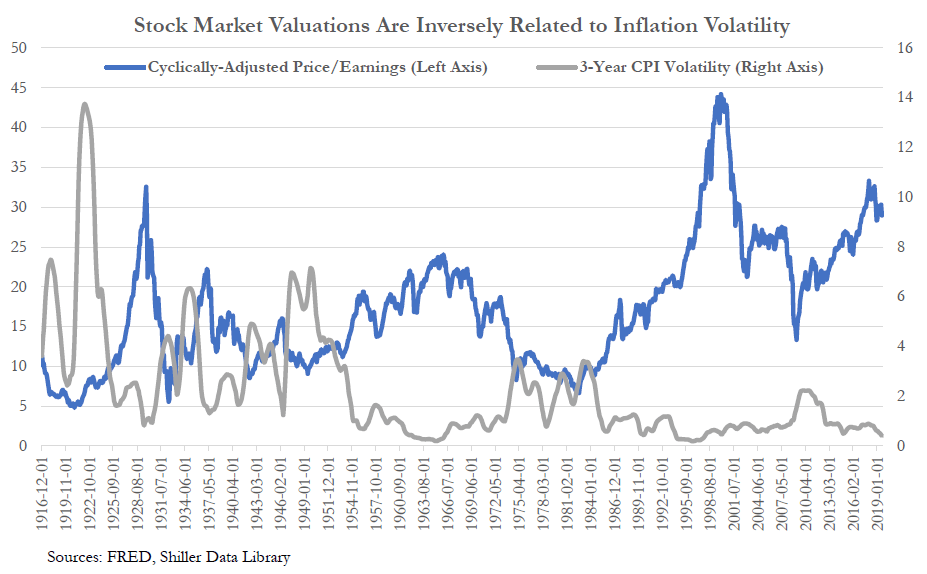

When inflation is high policymakers face a dilemma. 2 days agoLets put that pay increase in context. High inflation has historically correlated with lower returns on equities.

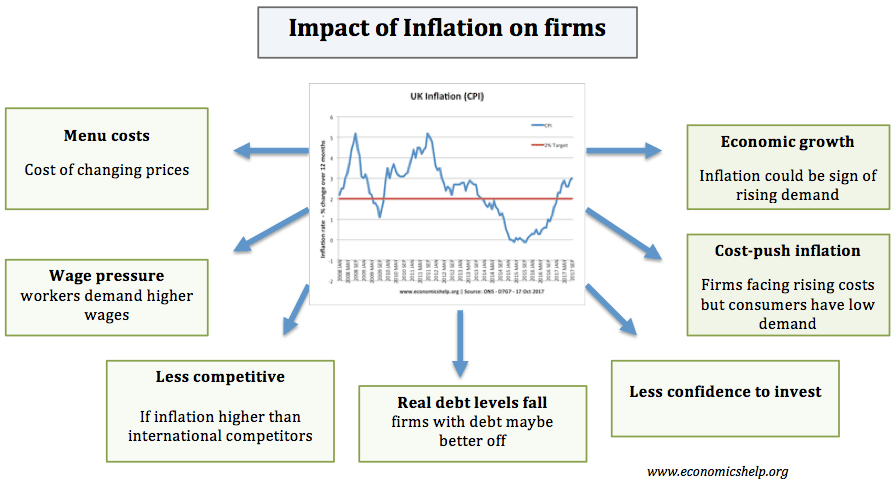

As a result these actions by households stimulate capital productivity and result in an increase in economic growth. Disruptions in the economy caused by high inflation can decrease stock prices and earnings for companies which increases uncertainty. Ad Inflation A Perennial Investor Concern.

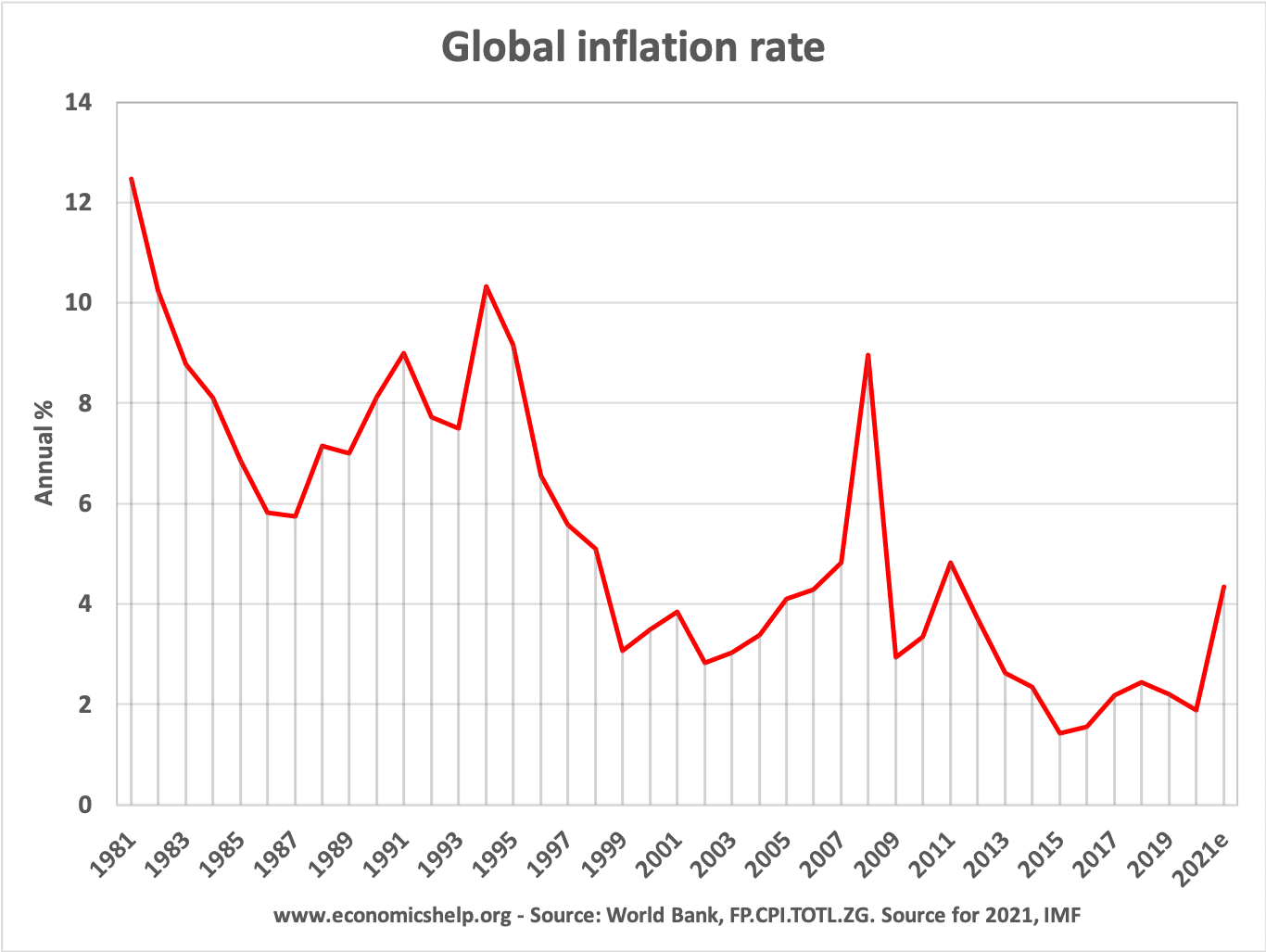

The primary cause for inflation is when the demand for a good or service is greater than the available goods or services. Well rising prices tend to weigh more on growth stocks than on more established companies. Visit PIMCOs Analysis Content on This Topic.

3Because it is harder to stay aware of how one product cost compares to another. Business competitiveness If one country has a much higher rate of inflation than others for a considerable period of time this will make its exports less price competitive in world markets. They would like to disinflate but fear the.

Younger companies also tend to suffer more from the increase in input costs that stems from. When actual and expected inflation are low there is a consensus that the monetary authority will try to keep them low. However inflations varying impact on stocks tends to increase the equity market volatility and risk premium.

Inflation increases uncertainty in the markets because. Heres the good news. Eventually this may show through in reduced export orders lower profits and fewer jobs and also in a worsening of a countrys trade balance.

During shorter periods of time however stocks have frequently been associated with negative inflation correlation making unexpected inflation particularly problematic. That uncertainty could lead to less activity in the economy such as businesses adjusting hiring decisions or households reducing their spending and ultimately stunt economic growth. High inflation drives up inflation expectations causing workers to demand wage increases to make up for the expected loss of purchasing power.

Explore Articles on Inflation Expectations Outlook and Policy. This paper presents a model of monetary policy in which a rise in inflation raises uncertainty about future inflation. Why does Inflation increase uncertainty in the markets1 choices Because consumers compare prices less in their shopping activities to find the cheapest deal2 Because sellers raise the prices very gradually and predictably for their products.

Tobin 69 proposes that an increase in inflation uncertainty leads to a decline in accumulated wealth prompting households to hold less non-interest-bearing assets but more real capital assets. When loans become cheap too much money chases too few goods and creates inflation. When inflation is high policymakers face a dilemma.

Setters raise the prices of their products very gradually and predictably. This paper presents a model of monetary policy in which a rise in inflation raises uncertainty about future inflation. It lowers the cost of borrowing and reduces unemployment.

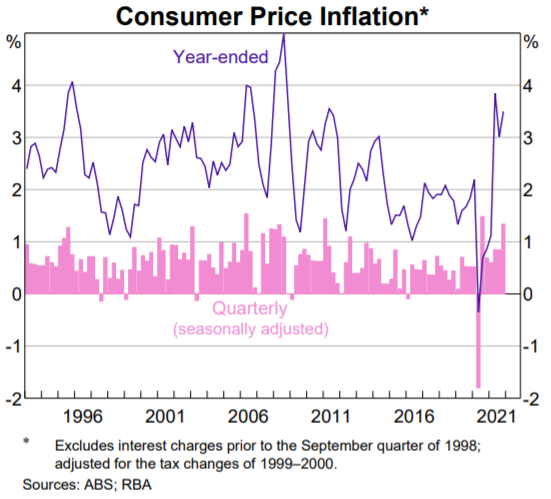

10 Cost-Push Inflation The second cause is cost-push inflation. Moderation was also seen in. This cycle plays out as follows.

They would like to disinflate but fear the recession that would result. Finally inflation and deflation make it harder to anticipate how other aspects of the economy may change such as interest rates wages taxes and profits. The prices of everything increase even though neither demand nor supply has changed.

This is known as demand-pull inflation and leads to a price increase. Annual CPI inflation declined slightly in April with the 12-month figure falling slightly to 83 from 85 in March. When inflation is low there is a consensus that the monetary authority will try to keep it low.

Because inflation erodes the value of cash it encourages consumers to spend and stock up on items that are slower to lose value.

Inflation Advantages And Disadvantages Economics Help

How Inflation Affects The Stock Market Economics Help

0 Comments